Employee Owned Trusts were created in 2014 by the UK government to allow businesses to be sold in a way that encouraged employees to be more engaged in the company. The main benefit is that staff would be able to take a more active role in running the business, whilst allowing the owner to retire from the company and pass the company to their employees, whilst the owner enjoys a sale with a zero-rated Capital Gains Tax.

Tax efficient sales process

When you sell a business, a tax event happens, you have realised a capital gain which incurs a tax at 20% of the sale proceeds. So if a company is sold for £5,000,000 the basic tax is valued at £1,000,000. There are ways of reducing this which are based on your own personal circumstances.

Deductions

Personal Tax Allowances

When writing in the UK, you have a personal Capital Gains Tax Allowance of £6,000 per annum which means you will pay no tax on that first £6,000.

The amount of personal allowance changes based on the government, and you are unable to claim unused allowances in previous years.

Business Asset Disposal Relief (Previously Entrepreneurs Relief)

With Business Asset Disposal Relief you can claim a deduction in Captial Gains Tax to 10%, there are criteria around the eligibility of the business owner, which you can find here

There are also limits to business asset disposal relief. You can only claim a total of £1,000,000 in your lifetime, meaning if you plan to sell a business worth more than £10,000,000 or during your lifetime you are likely to sell other businesses you may have to pay the full 20% rate.

With Employee Owned Trusts the qualified seller receives a zero-rated Capital Gains Tax Rate for the value of the business sold to the Employee Owned Trust. At the moment the Government has added no limitations on the amount of benefit a seller can receive. Meaning you could save the full 20% Capital Gains Tax on multiple business sales over your lifetime.

There are limitations to this tax benefit

- At least 51% of the business needs to be sold to the trust

- If the previous owner is to retain shares or a role within the business then at least 4 members of staff are needed for each owner or member of the owner’s family.

- The sale price needs to be at the value of the business, i.e. the business is not allowed to be sold for more than the current independently verified value of the business

Employee Benefits

As a member of the Employee Owned Trust, the staff are able to receive an annual benefit of £3600 tax-free. They get to share in the profits of the business which are distributed by the Trust to all members in an agreed way. Any additional payments are liable for income tax and national insurance payments.

The Employees also get to nominate board members for the business, usually through a staff council election. These staff represent the staff and have a deciding vote on how the business is managed moving forward. Meaning staff needs are considered as part of running the business.

Company Structure

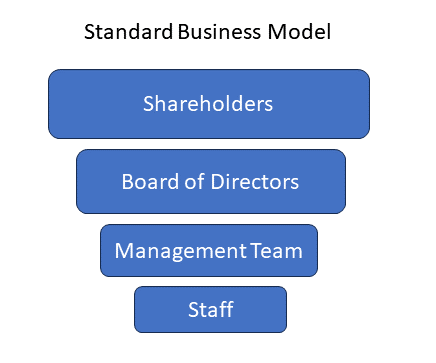

The Company Structure after the sale to an Employee Owned Trust is not unlike a standard business model;

Within a standard model, the staff are answerable to the management team structure and do as instructed to perform tasks as per their job description. The management team are answerable to the board of directors who decide on the direction of the business and implement strategies as needed. The directors are themselves answerable to the shareholders who are the owners of the company.

Shareholders generally receive the profit of the company as part of any distribution of dividends. Some people may exist within multiple sections of this structure, for example, within owner-managed businesses, the owner (shareholder) is also on the board of directors and also part of the management team. Within some businesses, some members of staff may own shares in the business.

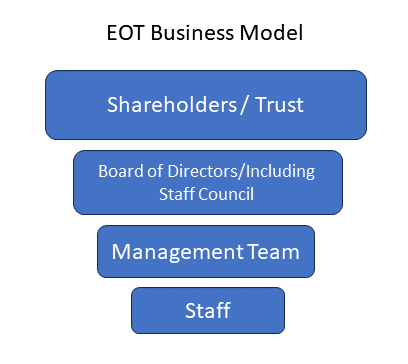

Within an Employee Owned business, the lower part of the structure is the same as any business. Staff work for managers and complete their tasks as needed. Managers themselves are still answerable to the board of directors. However, the board will consist of members of staff who are voted in as a member of the staff council.

The shareholders will consist of any shareholders but also include the trust. Any available dividends will be passed to the shareholders as normal, however, the monies distributed to the trust will then be redistributed to the staff based upon agreed rules.

Company Benefits

The company now being owned by the trust has to work for the benefit of its new shareholders, this can mean the business will run differently than under a normal business model. however, the Employee Owned business also needs to ensure that it is commercially viable, the trustees of owning trust also sit on the board of directors to ensure all decisions are for the benefit of the staff and the future of the business.

Whilst there are financial rewards for the outgoing owner and the staff moving forward, the company itself has the benefit of being run with the long term in mind. Succession planning can be used to ensure that staff are trained to take over the role of the leadership team, giving security to the company.

Other benefits

- Improved employee engagement and retention – Staff tend to stay in companies where their voice is heard and they can see a direct benefit from the company’s performance

- Encourages innovation at all levels of the business – as staff are more likely to promote methods to increase the value of the business in turn what they receive.

- Improved business performance – a motivated staff will outperform a company with disengaged members of staff.

- higher resilience to market volatility – Engaged staff will help to protect the business through industrial turmoil.

Community Benefits

Many Employee Owned businesses create community funds to support the local causes at the heart of the staff, this can be used to support local charities in the name of the trust and its members or to offer bursaries to those in need.

Social Media Links

More Posts

Our Office

We are based in Sheffield but cover the whole of Great Britian

Contact Us

07932 437454

Info@Mobius-Capital.com

Office Hours

Mon-Fri: 9am – 5pm

Sat-Sun: Closed

Follow Us